I'm sure you've heard of the famous Boston Consulting Group matrix -or BCG Matrix for friends. It may sound like a vintage consulting tool from the 70s... and you're right. But the truth is that, when used properly, it is still super useful for understanding how your products or business units are doing, and, above all, what decisions to make with each one.

Let's get down to business.

What is the BCG Matrix?

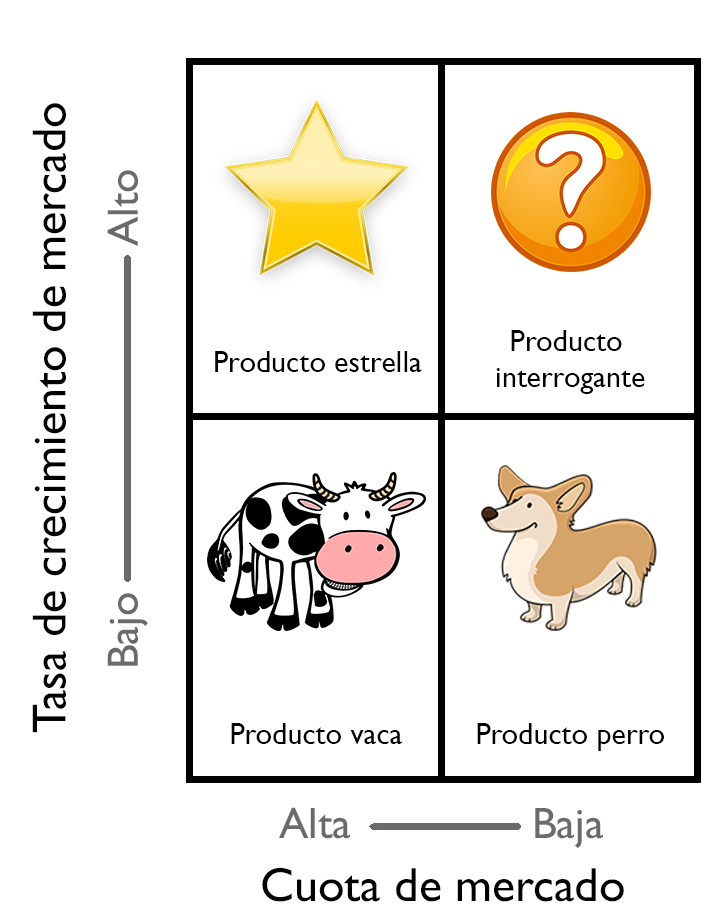

It is a 2×2 matrix, very visual and very effective. It is used for classify products, services or business units along two axes:

- Market growth (high or low)

- Relative market share (high or low)

The result is four quadrants with names that, once you understand them, you will never forget:

Star Product

This product, as its name indicates, would be the current star of our business (or one of the stars, we can have several). Its growth rate is on the rise (it is increasingly in demand) and we also have a very high market share (sales).

It is mandatory that we continue to promote this product until it becomes a cow-type product (see below). If we do not succeed, it will eventually become a dog-type product.

Real example: iPhone 15 Pro Max. The premium mobile market keeps moving, and Apple is still on top.

Product Cow

Cow products have a low growth rate in the market while we have a high market share. This means that it is already a mature and established product, and does not need a large investment on an ongoing basis.

This product is usually the economic base of our business. It is called cow because we intend to milk it, take advantage of the fact that we have a high sales quota and we do not have to reinvent anything because it is an already established product.

The profits from this product should be invested in new flagship products, so that, over time, they will eventually become a cow.

Example: Coca-Cola Classic. Few surprises, but very solid revenues.

Product Question

It is a product that has a high growth rate (it generates more and more interest) but for which we do not yet have a significant market share. In this case, we should try to increase our share to make it a kind of star product. Otherwise, we risk it becoming a product of little or no relevance to our business (dog-like).

Products with a high growth rate usually require considerable investment in time and money. It is important to keep an eye on them because having a low market share can be very detrimental.

Example: New (mainly Chinese) electric car brands. The market is going full steam ahead, but not all brands will survive.

Product Dog

The dog product has a low growth rate and our market share is low. This can mean that the product is often not profitable and generates a number of costs for us that are often not worthwhile.

Although it is also true that there are dog products that generate long-term benefits, whether economic or in terms of image, or simply help the business by generating synergies with other products of the company.

Example: DVD players. With streaming, they no longer make much sense in most homes.

And what do I do with this information?

Good question. This matrix is not just for sorting, is to make decisions:

- Stars → Invest, empower, grow them. There is a future here.

- Dairy cows → Keep, squeeze the benefits, but don't fall asleep.

- Questions → Analyze well. Some are worth investing in, others are not.

- Dogs → If they don't contribute anything, it's time to say goodbye.

Tips for getting the most out of it (for real)

Okay, so we have our products sorted in your quadrant... now what? This is where it gets interesting. The BCG Matrix is not just for labeling, but also for helping us to make better strategic decisions. Here are some practical ideas to take it to the next level:

1. Review your matrix periodically.

The market is not static and neither is your business. What today is a Star, tomorrow can become a Milk Cow... or even a Dog if you get lost.

Recommendation:

Do a review every quarter or every six months. Changes in the market, in your competitors or in your own strategy can move pieces.

Do not analyze products in isolation: look for synergies.

Sometimes a product with low profitability indirectly adds valueIt brings traffic, builds customer loyalty, or is a key part of a bundle or subscription.

Example:

Amazon Prime Video may seem like a «Dog» if analyzed by direct profitability alone. But it enhances the perceived value of the Prime service and helps build loyalty among millions of customers.

3. Complement with financial data

The BCG matrix focuses on growth and market share, but it does not take into account the profit margin, The company's profitability, acquisition costs, and actual profitability.

Tip:

Cross-reference the quadrants with financial KPIs: gross margin, CAC, LTV, ROI... This way you will see if your Dairy Cow is really giving milk or just eating hay.

4. Use the matrix to align your team.

The BCG Matrix can be a powerful internal communication tool. It helps marketing, product, sales and management understand which product to push, which to keep and which to let go.

Suggestion:

Have a workshop with your team. Put the products in the matrix together. Not only do you get valuable ideas, but you align visions and strategies.

5. Don't discard the “Dogs” without looking closely.

Yes, in theory the Dogs are disinvestment fodder. But sometimes they hide opportunities:

- What if you redesign the value proposition?

- What if you make a specific and profitable niche?

- What if it serves as a gateway to something bigger?

Real example:

LEGO brought back classic lines that seemed «dead» (like LEGO Pirates) thanks to community feedback and nostalgia. Result: high-margin niche products.

6. Use the matrix to prioritize your resources

Time, budget, attention... everything is limited. This tool gives you a clear way to decide where to focus your energy and when to stop.

Useful rule:

Invest the bulk of your budget in Stars and Question Marks with potential. Use cash cows to finance. And don't be afraid to let go of what doesn't contribute.

7. Adapt it to your business model

BCG logic can be applied beyond products: services, customers, sales channels, content lines, and even employees..

An example?

If you have a YouTube channel or a newsletter, you can classify your content according to its growth (visibility, subscriptions) and its impact (sales, engagement). It helps you decide what type of content to promote.

Is it still useful in 2025?

Yes, very much so. Although there are more modern tools (such as RICE Analysis, Growth Share Matrix 2.0, etc.), the BCG Matrix remains a quick and visual way to view your product portfolio., prioritize efforts and focus the strategy.

The best part? That works the same for a freelancer, a startup or a multinational company..

Find out more at our blog.